Best Forex Credit Cards

Smart International Spending

Find cards with the best foreign exchange rates and international benefits.

Compare Best Forex Credit Cards

Find and compare the best credit cards side by side. Make informed decisions based on rewards, fees, and benefits.

Niyo Global Card by Equitas Bank

BookMyForex YES Bank Forex Card

HDFC Bank Regalia ForexPlus Card

HDFC Bank Multicurrency Platinum ForexPlus Chip Card

Axis Bank Club Vistara Forex Card

ICICI Bank Student Forex Prepaid Card

Axis Bank World Traveller Forex Card

State Bank Multi-Currency Foreign Travel Card

IndusInd Bank Multi-Currency Travel Card

ICICI Bank Sapphiro Forex Prepaid Card

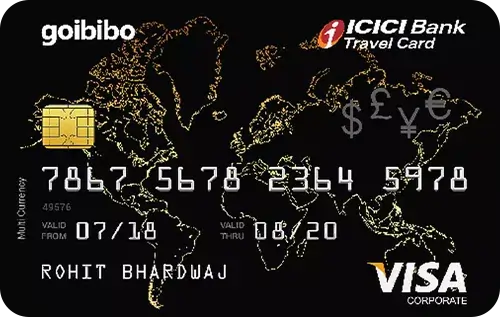

Goibibo ICICI Bank Forex Prepaid Card

ICICI Bank Coral Prepaid Forex Card

IDFC FIRST Multi-Currency Forex Card

Yes Bank Multicurrency Travel Card

Everything You Need to Know

Comprehensive guide to understanding credit cards and making informed decisions.

Forex Credit Cards are specially designed for international travelers to save on foreign exchange transactions. These cards offer benefits such as zero forex markup fees, lower currency conversion rates, reward points on global transactions, and travel-related perks like airport lounge access and travel insurance.

For example, a forex credit card may provide 0% forex markup on international spends, while another card may offer 2% forex cashback on every non-INR transaction. The right forex credit card ensures seamless and cost-effective spending abroad.

Forex credit cards also help reduce hidden charges on international transactions, making them a better alternative to regular credit cards that typically charge 3.5% forex markup on global payments.

Although all forex credit cards help reduce or eliminate forex fees, the specific benefits may vary. Some cards provide zero forex markup on all foreign transactions, while others may charge a reduced forex fee of 1-1.5% instead of the standard 3.5%.

For example, a card offering zero forex markup on international transactions but giving only 1 reward point per ₹100 spent may not be better than a card charging 1.5% forex markup but offering 5X reward points on international transactions.

Forex credit cards also come with international travel perks like:

- Complimentary global airport lounge access

- International travel insurance

- Lost baggage protection & trip delay compensation

- Exclusive hotel & airline discounts

Forex credit cards offer a range of benefits for frequent international travelers. Here's why they're worth considering:

- Zero or low forex markup fees, making international spending more affordable.

- Earn accelerated reward points on global transactions, maximizing value.

- Complimentary access to international airport lounges.

- Travel insurance covering trip delays, lost baggage, and medical emergencies.

- Discounted foreign currency withdrawal fees at international ATMs.

Before selecting a forex credit card, consider these factors:

- Forex Markup Fees – Choose a card with 0% or low forex markup charges.

- Reward Points on International Spending – Look for a card that offers high rewards on foreign currency transactions.

- Lounge Access & Travel Benefits – Select a card with complimentary international lounge visits and travel perks.

- ATM Withdrawal Charges – If you plan to withdraw cash abroad, check for low or zero ATM withdrawal fees.

- Annual Fees & Charges – Compare the card's yearly fees with the forex savings and benefits it provides.